Task News

Posted: August 10, 2021

Source: https://ens.dk/sites/ens.dk/files/Statistik/prisdatabase.xlsx / Jakob Jensen

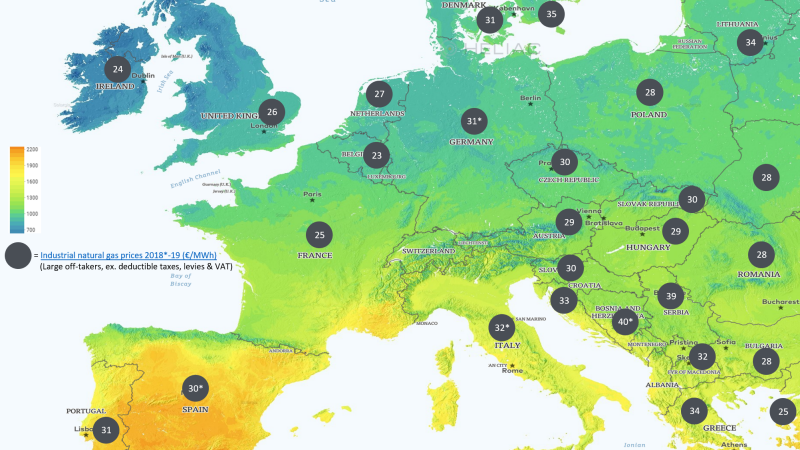

Many studies have shown the huge potential solar thermal has for clean heat production in industry. But so far, there have been comparatively few attempts to tap into this potential, partly because of high investment costs and partly because of end customers’ lack of knowledge about, and therefore trust in, industrial solar heat solutions. To remedy this, Danish Heliac’s Chief Commercial Officer Jakob Jensen sought to figure out how much solar thermal systems offered in Europe need to cost to be competitive with typical natural gas units if incentives are not part of the equation. He presented his findings at an IEA SHC Task 64 meeting on Solar Process Heat earlier this year. The map shows, in EUR/MWh, estimates for average natural gas prices paid by large energy consumers in 2018, excluding tax, levy and VAT deductions but including distribution and transmission costs.

Jensen started off by matching the levelised cost of solar heat (LCOH) to natural gas prices. He then calculated backwards how much a kilowatt of installed solar thermal capacity needs to cost, in EUR/kWth, in order to achieve a competitive LCOH.

The map shows that large off-takers in Europe paid an average of about 30 MWh/EUR for natural gas in 2018. Fossil fuel prices then dropped temporarily because of the outbreak of Covid-19 but are now back at pre-pandemic levels.

“Basically, my calculation is that if you want to be able to sell heat at 30 EUR/MWh, in order to stay competitive with gas-powered energy generation units, total installed system costs shouldn’t exceed so and so much EUR/kWth,” explained Jensen.

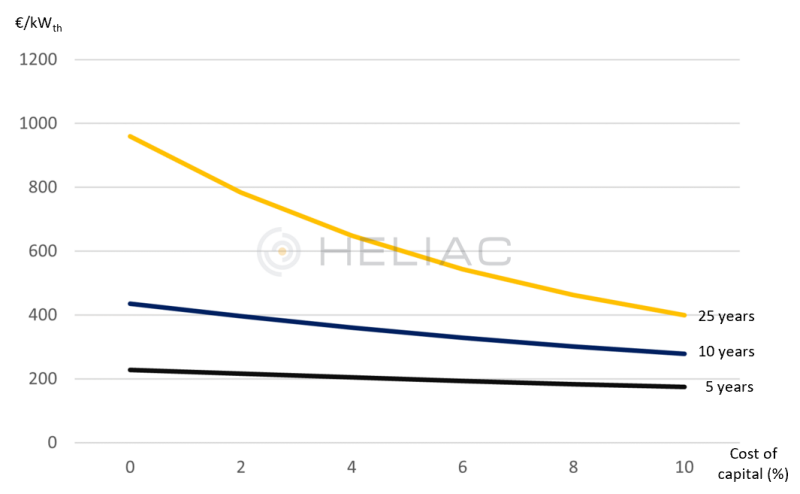

The most influential factors in Jensen’s LCOH calculations are the cost of capital or the discount rate and the duration during which an investment is expected to generate heat (see figure 1).

Figure 1: Total installed solar system costs as a function of capital costs and lifetime. All data points are based on an average annual DNI of 1,600 kWh/m2 and O&M costs of 1 % of the investment per year.

Source: Heliac

The graph shows that if the client has a no-interest loan and accepts a 25-year payback period, then the technology suppliers can sell their solar fields at around 950 EUR/kWth (left end of yellow curve). A 10 % interest rate and a five-year payback period, on the other hand, means suppliers cannot ask for more than 175 EUR/kWth to commission a system (right end of black curve).

“So, one option is to get to 25 years,” said Jensen. “The equipment may last that long, but industrial customers won't appreciate that sort of a payback period. However, there are some investors, such as infrastructure funds, utilities or large-scale energy infrastructure developers, willing to consider a 25-year deal.” To negotiate with these investors, Jensen suggest using equipment that can be moved to another location. If an industrial heat client then shuts down the connected factory after 10 years, the equipment can be put up at another customer’s site, where it will be run for the remainder of the 25-year contract period.

During his presentation, Jensen also listed other factors that could strengthen the business case for industrial solar heat investments:

- Economies of scale can be crucial. The bigger a solar field is, the lower the bill-of-material, sales, permit and specific costs per kWth will be. Installation will be faster as well.

- Look for clients that operate sites with high DNI, pay high gas prices and produce 7 days a week, all year round. Weekday-only production will result in the loss of nearly a third of a system’s annual yield if there is no storage available.

- Financial risks can be lowered by offering heat purchase agreements to customers with a strong balance sheet, so they are able to pay for energy supplies over the entire contract period.

Solar district heating system put up by Heliac in Lendemarke, Denmark. The trackers consist of concentrating Fresnel lenses that focus sunlight on a square-shaped receiver behind them. Run by energy utility E.ON, the installation provides hot water at 95 °C.

Photo: Søren Nielsen

Organisations mentioned in this article: